EU Adopts Carbon Border Tax to Green Industrial Imports

The European Parliament and EU member states announced on Tuesday morning that they have adopted an unprecedented mechanism to green Europe’s industrial imports by making companies pay for the carbon emissions associated with their production. This system, commonly known as the „carbon border tax“, will subject imports in several sectors (steel, aluminum, cement, fertilizers, electricity, but also hydrogen) to the EU’s environmental standards. The goal is to encourage European companies to switch to more environmentally friendly imports within the EU. A test period will begin in October 2023 and the implementation of the mechanism depends on a successful negotiation this week about ending free emission quotas. The European Parliament wants these quotas to be phased out completely by 2027.

What is a Carbon Border Tax?

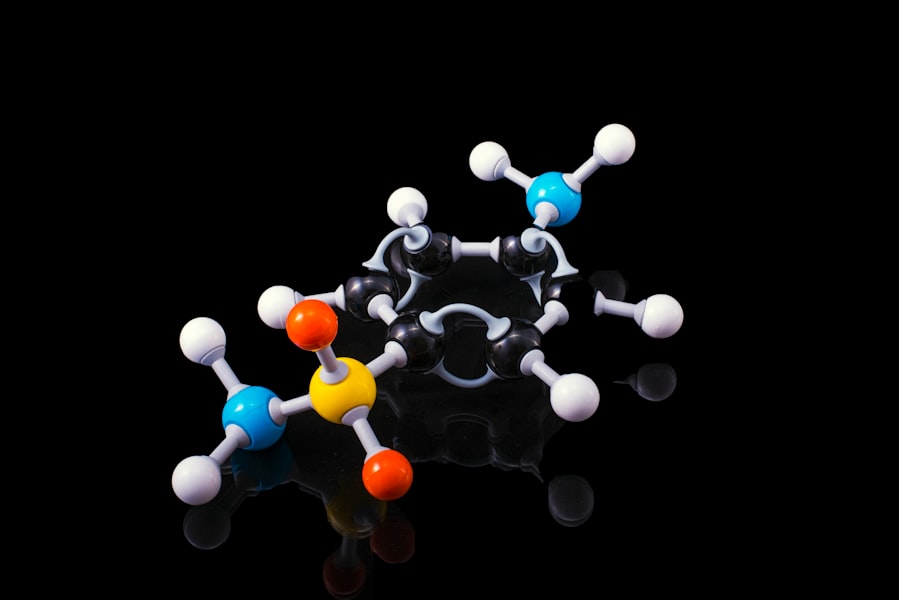

A Carbon Border Tax is a type of carbon pricing policy that applies to imports and exports. It is designed to level the playing field for domestic producers by making sure that imported goods are subject to the same carbon pricing as domestic products. This type of tax can be used to discourage countries from importing high-carbon goods and encourage them to produce more sustainable products. The goal of this type of tax is to reduce global greenhouse gas emissions while promoting fair trade practices.You might also like this article: This is the title of test post. Picture source: Jason Blackeye